UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ |

|

☒ | Definitive Proxy Statement |

☐ |

|

|

|

|

|

☐ | Soliciting Material under Rule 14a-12 |

HEALTHSTREAM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials: |

☐ | Fee |

|

|

HEALTHSTREAM, INC.

500 11TH Avenue North, Suite 1000

Nashville, Tennessee 37203

(615) 301-3100

NOTICE OF 20222024 ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 26, 202230, 2024

Dear Shareholder:

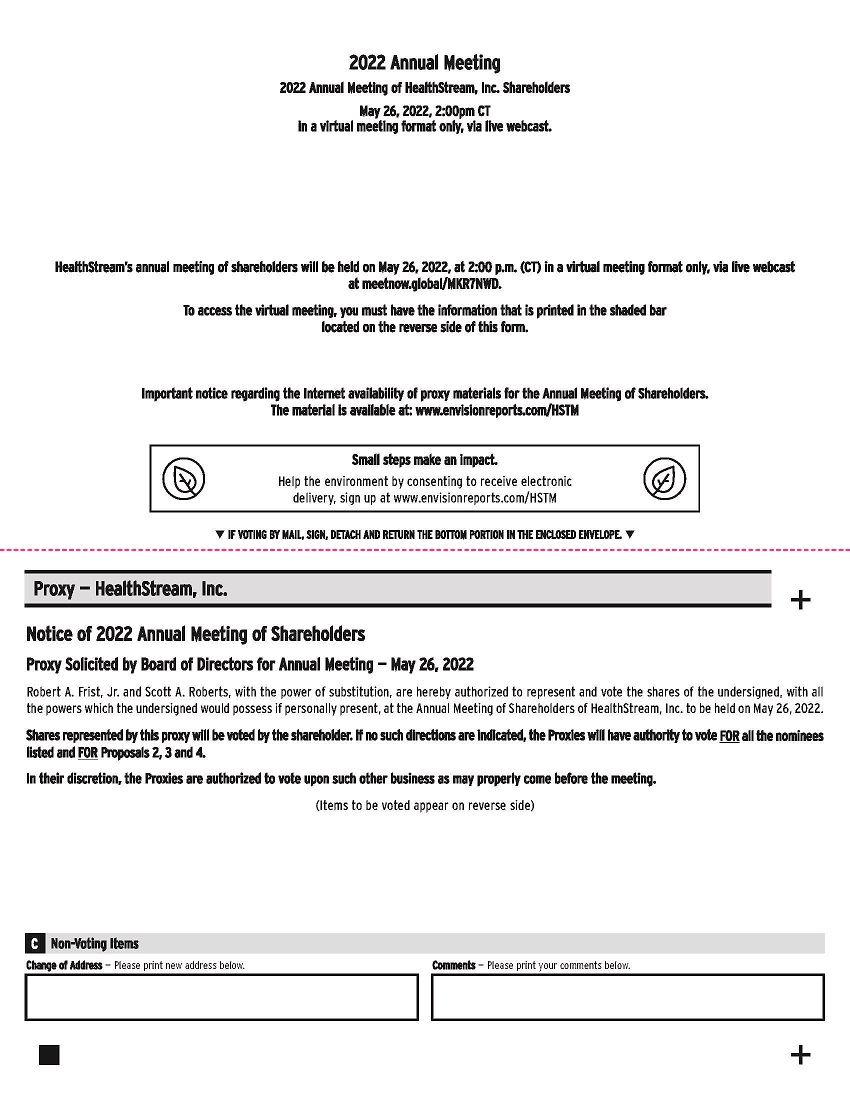

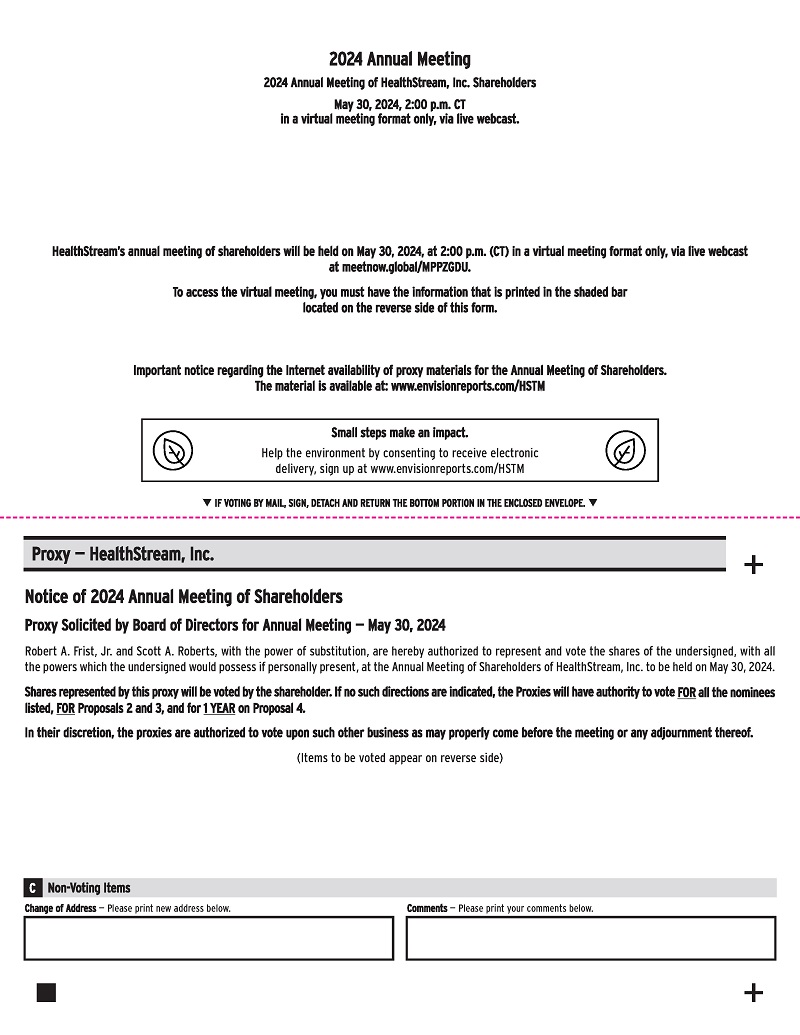

On Thursday, May 26, 2022,30, 2024, HealthStream, Inc. will hold its 20222024 Annual Meeting of Shareholders. Due to public health concerns regarding the coronavirus pandemic and to assist in protecting the health and well-being of our shareholders and employees, theThe meeting will be held virtually via the Internet, with no physical in-person meeting. Shareholders of record and holders of shares in “street name,” in each case as of March 28, 2022,April 1, 2024, will be able to listen, vote, and submit questions, regardless of location, via the Internet by following the procedures set forth below in this proxy statement below under “How Do I Attend the Annual Meeting?”. The meeting webcast will begin at 2:00 p.m. Central Daylight Time on May 26, 2022,30, 2024, and we encourage you to access the meeting prior to the start time.

At this meeting, we will consider the following proposals:

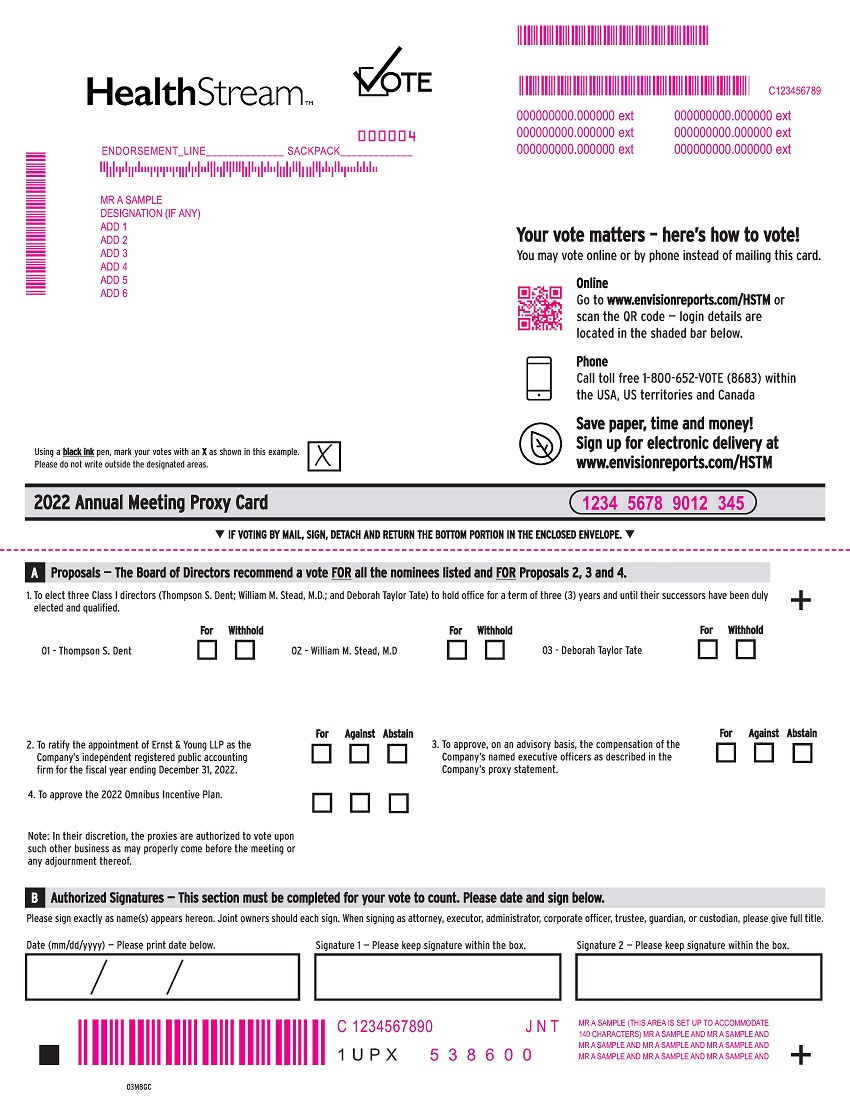

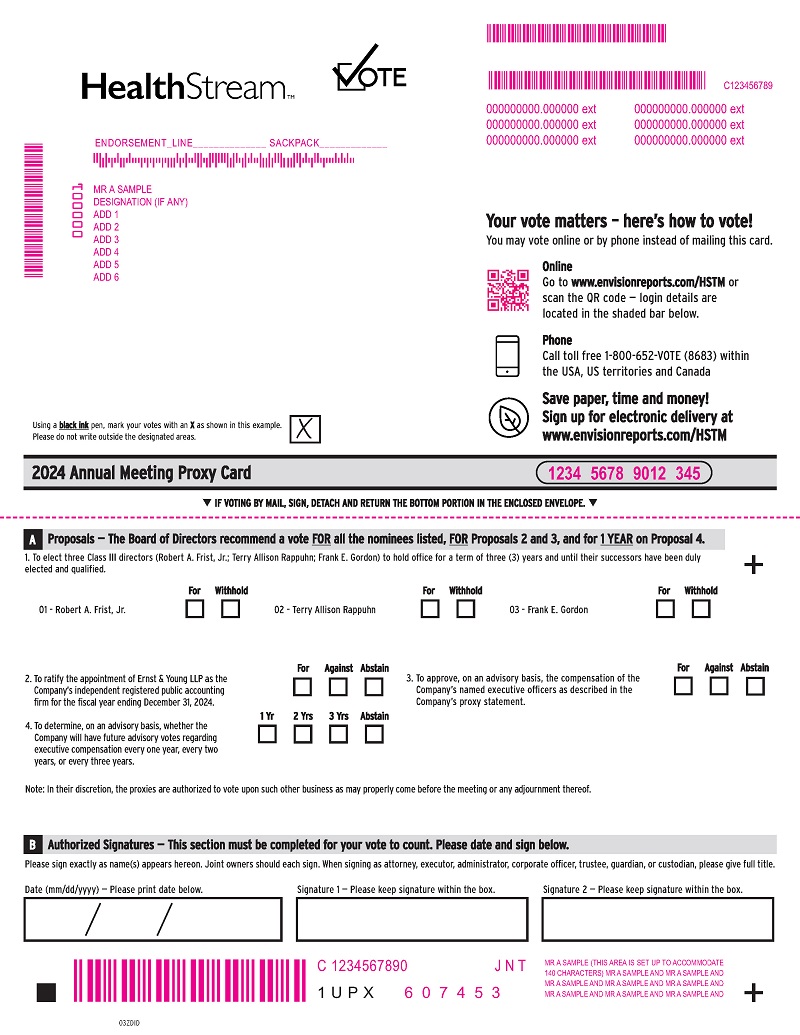

1. | to elect the three (3) persons nominated by the Board of Directors identified in this proxy statement as Class |

2. | to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, |

3. | to approve, on an advisory basis, the compensation of the Company’s named executive officers as described in the Company’s proxy statement that accompanies this notice; and |

4. | to |

5. | to transact such other business as may properly come before the meeting. |

In reliance on SEC rules which allow issuers to make proxy materials available to shareholders on the Internet, we are mailing our shareholders a notice instead of paper copies of our proxy statement and our annual report. The notice contains instructions on how to access those documents on the Internet. The notice also contains instructions on how shareholders can receive a paper copy of our proxy materials, including the proxy statement, our 20212023 annual report, and a form of proxy card.

Whether or not you plan to attend the virtual meeting, we request that you vote as soon as possible.

| By the Order of the Board of Directors, | ||

| ||

Nashville, Tennessee | Robert A. Frist, Jr. | |

April | Chief Executive Officer and Chairman of the Board | |

TABLE OF CONTENTS

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 26, 2022:30, 2024 (the "Annual Meeting"): The Company’s Proxy Statement, Proxy Card,HealthStream, Inc.’s (the “Company” or “HealthStream”) proxy statement, proxy card, and 20212023 Annual Report to Shareholders are available to registered and beneficial shareholders at http://www.edocumentview.com/HSTM. This notice is not a form for voting and presents only an overview of the more complete proxy materials whichthat contain important information. We encourage all shareholders to access and review the proxy materials before voting.

These materials were made available to shareholders on April 14, 2022.11, 2024.

What is the Purpose of the Annual Meeting?

At HealthStream’s Annual Meeting, shareholders will act upon (i) the election of three (3) persons nominated by the Board of Directors (the “Board”) and identified in this proxy statement as Class IIII directors, (ii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022,2024, (iii) the approval, on an advisory basis, of the compensation of the Company’s named executive officers under applicable SECSecurities and Exchange Commission (“SEC”) rules (the “Named Executive Officers”) as described in this proxy statement, (iv) the approval ofdetermination, on an advisory basis, regarding whether the 2022 Omnibus Incentive Plan as described in this proxy statement;Company will have future advisory votes regarding executive compensation every one year, every two years, or every three years, and (v) any other matters that may properly come before the meeting. The Annual Meeting will be held on May 26, 2022,30, 2024, and will begin at 2:00 p.m. Central Daylight Time.

What are the Board’s Recommendations?

Our Board recommends that you vote:

● | FOR the election of each of the nominees set forth in this proxy statement to serve as Class |

● | FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm; |

● | FOR the approval, on an advisory basis, of the compensation of the |

● | FOR the approval of |

What Happens if I Do Not Give Specific Voting Instructions?

Shareholders of Record. If you are a shareholder of record (that is, if you hold your shares in your own name with our transfer agent) and you:

● | Indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board; or |

● | Sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in “street name” (that is, if you hold your shares through a broker, bank, or other nominee), you have the right to direct your broker, bank, or other nominee how to vote your shares and will receive materials and voting instructions from any such nominee with respect to voting your shares. New York Stock Exchange (“NYSE”) Rule 452 (“Rule 452”) provides that brokers, banks, and other nominees may not exercise their voting discretion on specified non-routine matters without receiving instructions from the beneficial owner of the shares. Because Rule 452 applies specifically to securities brokers, virtually all of whom are governed by NYSE rules, Rule 452 applies to all companies listed on a national stock exchange including companies (such as the Company) listed on the Nasdaq Stock Market.Market (“Nasdaq”). Therefore, since proposal one (the election of directors), proposal three (the non-binding advisory vote on executive compensation), and proposal four (the approvalnon-binding advisory vote on the frequency of our 2022 Omnibus Incentive Plan)future advisory votes regarding executive compensation) are not considered routine under Rule 452, if you do not issue instructions to your broker, bank, or other nominee with respect to these proposals, your broker, bank, or other nominee will not be allowed to exercise its voting discretion (the “non-vote”). As such, with respect to these proposals, broker non-votes will not impact the outcome of proposals one, three, or four. For proposal two, the ratification of the independent registered public accounting firm, absent receiving instructions from you, your broker may vote your shares at its discretion on your behalf. If your shares are held in street name and you do not give your broker, bank, or other nominee instructions on how to vote, your shares will still be counted toward the quorum requirement for the Annual Meeting provided that your broker, bank, or other nominee votes your shares utilizing its discretionary authority for proposal two as noted above.

How Do I Attend the Annual Meeting?

As the result of public health concerns arising from the COVID-19 pandemic, ourOur Annual Meeting will be held on a virtual basis, meaning that you attend the Annual Meeting via the internet.Internet. Shareholders of record and holders of shares in street name, in each case as of March 28, 2022,April 1, 2024, may attend the virtual meeting by following the instructions set forth below.

Shareholders of Record. In order to attend the Annual Meeting, shareholders of record must have the information that is printed on their notice or proxy card. Shareholders of record may attend the virtual meeting by logging in at www.meetnow.global/MKR7NWDMPPZGDU and providing the applicable information set forth on their notice or proxy card along with the password for the Annual Meeting (HSTM2022).card.

Street Name Holders. In order to attend the Annual Meeting, holders of shares in street name will need to register to attend in advance. To register to attend the Annual Meeting, street name holders must (i) follow the procedures provided by their broker, bank, or other nominee that holds their shares for obtaining a legal proxy; and (ii) register with Computershare by submitting proof of such holder’s legal proxy reflecting such holder’s HealthStream holdings, along with such holder’s name and email address, to Computershare. Requests for registration must be labeled as “Legal Proxy” and must be received no later than 2:00 p.m. Central Daylight Time on May 23, 2022.27, 2024. Street name holders will receive a confirmation of their registration by e-mail after Computershare has received their registration materials.

Requests for registration should be directed to Computershare by either e-mail or mail as follows:

By e-mail:

Forward the email from your broker or attach an image of your legal proxy to legalproxy@computershare.com

By mail:

Computershare

HealthStream, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

After a street name holder has received confirmation of registration, the street name holder may participate in the meeting by logging in at www.meetnow.global/MKR7NWDMPPZGDU and entering the control number provided with the confirmation of registration, along with the password for the Annual Meeting (HSTM2022).registration.

Shareholder Questions. We intend to answer questions pertinent to Company matters in accordance with our rules of conduct and procedures as time allows during the Annual Meeting. Questions may be submitted over the internetInternet prior to or during the Annual Meeting by holders of record and holders of shares in street name participating in the Annual Meeting on a virtual basis who have logged in to the annual meeting page at www.meetnow.global/MKR7NWDMPPZGDU and have followed the instructions on such webpage for submitting a question. In order to allow maximum participation, we will limit each holder to one question. If any question submitted by a holder of record or holder in street name is not addressed at the Annual Meeting, such stockholder or holder in street name may contact the Company’s Investor Relations department following the Annual Meeting at 500 11th Avenue North, Suite 1000, Nashville, Tennessee 37203 or by contacting us at (615) 301-3237 or at ir@healthstream.com.

Other Information. The meeting webcast will begin at 2:00 p.m. Central Daylight Time on May 26, 2022,30, 2024, and we encourage you to access the meeting prior to the start time. Rules of conduct and procedures for the Annual Meeting will be available on the website set forth above once you access the meeting.

If you have difficulty accessing the meeting or have other technical difficulties, please call the technical support number that will be posted on the Annual Meeting log-in page at www.meetnow.global/MKR7NWD.MPPZGDU.

For information regarding voting at the Annual Meeting (as well as other methods of voting), see below under “How Do I Vote?”

Who is Entitled to Vote at the Annual Meeting?

The Board has fixed the close of business on Monday, March 28, 2022April 1, 2024 as the record date. Shareholders of record of our common stock at the close of business on March 28, 2022April 1, 2024 may vote at this meeting.

As of the record date, there were 30,582,44730,397,886 shares of our voting common stock outstanding. These shares were held by approximately 12,15116,391 record holders. Every shareholder is entitled to one vote for each share of common stock the shareholder held of record on the record date.

Who is Soliciting My Vote?

This proxy solicitation is being made and paid for by HealthStream. In addition, we have retained Computershare and Georgeson Shareholder Communications to assist in the solicitation. We will pay these entities an aggregate of approximately $6,995$7,999 plus out-of-pocket expenses for their assistance in connection with the solicitation. Our directors, officers, and other employees not specially employed for this purpose may also assist in the solicitation of proxies. They will not be paid additional remuneration for their efforts. We will also request brokers and other fiduciaries to forward proxy solicitation materialmaterials to the beneficial owners of shares of the common stock that the brokers and fiduciaries hold of record. We will reimburse them for their reasonable out-of-pocket expenses.

On What Matters May I Vote?

You may vote on (i) the election of the three (3) persons nominated by the Board and identified in this proxy statement to serve as Class IIII directors of our Board, (ii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022,2024, (iii) the approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers as described in this proxy statement, (iv) the approval ofdetermination, on an advisory basis, regarding whether the 2022 Omnibus Incentive Plan as described in this proxy statement,Company will have future advisory votes regarding executive compensation every one year, every two years, or every three years, and (v) any other matters that may properly come before the meeting.

Why Did I Receive a One-Page Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

Pursuant to rules adopted by the SEC, the Company has elected to provide access to its proxy materials via the Internet. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s shareholders. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

I Share an Address Withwith Another Shareholder, and We Received Only One Paper Copy of the Proxy Materials. How May I Obtain an Additional Copy of the Proxy Materials?

The Company has adopted a procedure called “householding” in accordance with SEC rules. Under this procedure, the Company is delivering a single copy of the Notice and, if requested, this proxy statement and the Annual Report to multiple shareholders who share the same address unless the Company has received contrary instructions from one or more of the shareholders. This procedure reduces the Company’s printing costs, mailing costs, and fees. Shareholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, the Company will deliver promptly a separate copy of the Notice and, if requested, this proxy statement and the Annual Report to any shareholder at a shared address to which the Company delivered a single copy of any of these documents. To receive a separate copy of the Notice and, if requested, this proxy statement or the Annual Report, shareholders may write or call the Company at the following address and telephone number:

HealthStream, Inc.

Investor Relations Department

500 11th Avenue North

Suite 1000

Nashville, Tennessee 37203

Telephone Number: (800) 845-1579

Email: ir@healthstream.com

How Do I Vote?

Your vote is important. Whether or not you plan to attend the meeting on a remote basis, we urge you to submit your voting instructions to the Company as soon as possible (and, in any event, prior to the meeting).

Shareholders of Record (Prior to Annual Meeting). If you are a holder of record, you may vote in advance of the Annual Meeting (1) via the Internet by following the instructions provided in the Notice, (2) by mail, if you requested printed copies of the proxy materials, by filling out the vote instruction form and sending it backreturning your proxy card in the envelope provided,manner described below, or (3) by telephone, if you requested printed copies of the proxy materials, by calling the toll freetoll-free number found on the proxy card. Alternatively, you may vote at the Annual Meeting on a remote basis as described below.

If you requested printed copies of the proxy materials and properly sign your proxy card and return it in the prepaid envelope, your shares will be voted as you direct. If you requested printed copies of the proxy materials and return your signed proxy card but do not mark the boxes showing how you wish to vote, your shares will be voted in the manner recommended by the Board on all matters presented in this proxy statement.

The deadline for shareholders of record to submit voting instructions by telephone or the Internet is 11:59 p.m. Eastern Daylight Time on Wednesday, May 25, 2022.29, 2024. For information about shareholders of record changing their vote, see below under “Can I Change My Vote?”

Beneficial Owners of Shares Held in Street Name (Prior to Annual Meeting). If you hold your shares in street name, your broker, bank, or other nominee will provide you with materials and instructions for voting your shares, which may allow you to vote your shares prior to the Annual Meeting by using the internetInternet or a toll-free telephone number. If you hold shares through more than one broker, bank, or other nominee, you will receive separate materials and voting instructions from each such nominee. You will need to separately follow the instructions received from each broker, bank, or other nominee through which you hold shares in order to ensure that all of your shares are voted. The deadline for street name holders to submit voting instructions by telephone or the Internet is 11:59 p.m. Eastern Daylight Time on Wednesday, May 25, 2022.29, 2024. For information about holders in street name changing their vote, see below under “Can I Change My Vote?”

Voting at Annual Meeting. Alternatively, shareholders of record and holders of shares in street name, in each case as of March 28, 2022,April 1, 2024, who have logged into the Annual Meeting at www.meetnow.global/MKR7NWDMPPZGDU after following the instructions set forth above under “How Do I Attend the Annual Meeting,” may vote at the Annual Meeting by following the instructions regarding how to vote set forth on such webpage.

The meeting webcast will begin at 2:00 p.m. Central Daylight Time on May 26, 2022,30, 2024, and we encourage you to access the meeting prior to the start time.

How Can I Get Electronic Access to the Proxy Materials?

The Notice will provide you with instructions regarding how to:

● |

|

|

● | Instruct the Company to send future proxy materials to you by email. |

The Company’s proxy materials are also available on the Company’s website at www.healthstream.com.

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

How Will Voting on Any Other Business be Conducted?

We do not know of any business to be considered at the Annual Meeting other than (i) the election of three (3) persons nominated by the Board and identified in this proxy statement as Class IIII directors, (ii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022,2024, (iii) the approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers as described in this proxy statement, and (iv) the approval ofdetermination, on an advisory basis, regarding whether the 2022 Omnibus Incentive Plan.Company will have future advisory votes regarding executive compensation every one year, every two years, or every three years. Our Bylaws require shareholders of the Company to give advance notice of any proposal intended to be presented at any annual meeting. The deadline for this notice for the Annual Meeting has passed, and we did not receive any such notice made in compliance with our Bylaws. If any other business were to be properly presented at the Annual Meeting, Robert A. Frist, Jr., our Chairman and Chief Executive Officer, and Scott A. Roberts, our Chief Financial Officer, are authorized to vote on such matters at their discretion.

What is a “Quorum”?

A “quorum” is a majority of our outstanding shares of common stock. The shares may be present at the meeting (on a virtual basis) or represented by proxy. There must be a quorum for business to be conducted at the meeting. Abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

What Vote is Required to Approve Each Item?

Each of the director nominees must receive affirmative votes from a plurality of the shares voting to be elected.

The ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20222024 will be approved if the number of shares of Company common stock cast “FOR” such proposal exceed the number of shares of Company common stock cast “AGAINST” such proposal.

The approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers as described in this proxy statement will be approved if the number of shares of Company common stock voted “FOR” such proposal exceeds the number of shares of Company common stock voted “AGAINST” such proposal.

The approvaldetermination, on an advisory basis, regarding the frequency with which the Company will have future advisory votes regarding executive compensation will be based on which of the 2022 Omnibus Incentive Plan will be approved ifthree alternatives (every one year, every two years, or every three years) receives the numberplurality of the shares of Company common stock voted "FOR" such proposal exceed the number of shares of Company common stock cast "AGAINST"on such proposal.

What are My Voting Options on the Proposals?

With respect to Proposal 1, you may vote FOR or WITHHOLD your vote with respect to each of the three (3) nominees set forth in this proxy statement to serve as Class IIII directors on our Board.

With respect to Proposals 2 3, and 4,3, you may vote FOR the proposal, AGAINST the proposal, or you may elect to ABSTAIN from voting.

With respect to Proposal 4, you may vote FOR every one year, FOR every two years, FOR every three years, or you may ABSTAIN from voting.

What is the Effect of Abstentions?

If you abstain from voting on any proposals,Proposals 2, 3, or 4, you will be counted for purposes of determining whether a quorum exists. So long as a quorum is present, abstaining from any of the matters being voted on at the Annual MeetingProposals 2, 3, or 4 will have no effect on whether any such matter is approved.

What is the Effect of a Broker Non-Vote?

So long as a quorum is present, a broker non-vote will have no effect on the outcome of the election of Class III directors under Proposal 1 or whether proposals one, threeProposals 3 or four4 are approved.

Can I Change My Vote?

If you are a shareholder of record, you may change your vote by doing one of the following:

● | If you requested printed copies of the proxy materials, by sending a written notice of revocation to our |

● | If you requested printed copies of the proxy materials, by signing a later-dated proxy card and submitting it so that it is received prior to the Annual Meeting |

● | If you requested printed copies of the proxy materials and voted by |

|

|

● | If you previously voted by Internet prior to the Annual Meeting pursuant to instructions set forth in the Notice, by submitting another vote over the Internet prior to the Annual Meeting pursuant to |

● | By attending the Annual Meeting by visiting www.meetnow.global/ |

If you hold your shares in street name, you may change your vote by following the instructions provided by your broker, bank, or other nominee.

Who Will Count the Votes?

A representative of our transfer agent, Computershare, Louisville, Kentucky, will count the votes.

Where Can I Find the Voting Results?

We will announce the voting results at the Annual Meeting. We also will report the voting results on a Current Report on Form 8-K, which we expect to file with the Securities and Exchange Commission, or the SEC within four business days following the meeting.

When are Shareholder Proposals Due in Order to be Included in Our Proxy Statement for the 20232025 Annual Meeting?

Any shareholder proposals to be considered for inclusion in next year’s proxy statement under Exchange Act Rule 14a-8 must be submitted in writing to Secretary, HealthStream, Inc., 500 11th Avenue North, Suite 1000, Nashville, Tennessee 37203, prior to the close of business on December 15, 202212, 2024 and otherwise comply with the requirements of Rule 14a-8.

What is the Deadline for Submitting Other Business or Nominations for the 20232025 Annual Meeting?

If you bring business before the 2023 annual meetingAnnual Meeting which is not the subject of a proposal for inclusion in the proxy statement under Rule 14a-8, or if you want to submit a director nomination, our Bylaws require that you deliver notice in proper written form to our Secretary no later than February 25, 2023,March 1, 2025, but not before January 26, 202330, 2025 (or, if the 20232025 annual meeting is called for a date not within 30 days of May 26, 2023,30, 2025, the notice must be received not earlier than the 120th day prior to such annual meeting and not later than the 90th day prior to such annual meeting or, if the first public disclosure of the date of such annual meeting is less than 100 days prior to such annual meeting, the 10th day following the day on which public disclosure of the date of the annual meeting is first made). If such notice is provided to us by a shareholder under our Bylaws, a nominating shareholder must provide the information required by our Bylaws, including information regarding the nominating shareholder and affiliated persons, and otherwise comply with the terms of our Bylaws. In addition, if such notice is in relation to a proposed director nominee, the notice must include certain biographical information regarding the proposed nominee, a completed written questionnaire with respect to such proposed nominee regarding the background and qualifications of the proposed nominee (which questionnaire will be provided by the Secretary of the Company upon request), the proposed nominee’s written consent to nomination, and the additional information set forth in our Bylaws.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, (once effective), shareholders who intend to solicit proxies in support of director nominees other than Company nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 27, 2023.31, 2025.

Whom Should I Contact if I Have Questions?

If you have any questions about the Annual Meeting or these proxy materials, please contact Michael M. Collier,Sneha Oakley, our Senior Vice President, Corporate Development and General Counsel, or Mollie Condra, our Vice President, Investor Relations and Communications, at 500 11th Avenue North, Suite 1000, Nashville, Tennessee 37203, (615) 301-3237. If you are a registered shareholder and have any questions about your ownership of our common stock, please contact our transfer agent, Computershare, at 462 S. 4th Street, Suite 1600, Louisville, KY 40202, (800) 962-4284. If your shares are held in a brokerage account, please contact your broker.

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

You can access our Corporate Governance Principles, committee charters, Lead Independent Director charter, Code of Conduct, Code of Ethics for executive officers and directors, and other corporate governance-related information on our website, www.healthstream.com (under the “Corporate Governance” section of the Investor Relations page), or by addressing a written request to HealthStream, Inc., Attention: General Counsel and Corporate Secretary, 500 11th Avenue North, Suite 1000, Nashville, Tennessee 37203. Please note that our website is provided as an inactive textual reference and the information on our website, whether referenced here or elsewhere in this proxy statement, is not incorporated by reference in this proxy statement.

We believe that effective corporate governance is important to our long-term success and our ability to create value for our shareholders. With leadership from our Nominating and Corporate Governance Committee of our Board (the “Nominating and Corporate Governance Committee”), our Board regularly evaluates regulatory developments and trends in corporate governance to determine whether our policies and practices in this area should be enhanced. The Nominating and Corporate Governance Committee also administers an annual skills assessment process as well as an annual self and peer evaluation process for the Board. In addition, our directors are encouraged to attend director education programs.

The Board is divided into three classes (Class I, Class II, and Class III). At each annual meeting of shareholders, directors constituting one class are elected for a three-year term. Directors who were elected by the Board to fill a vacancy in a class whose term expires in a later year are elected for a term equal to the remaining term for their respective class. The Fourth Amended and Restated Charter of the Company provides that each class shall consist, as nearly as may be possible, of one-third of the total number of directors constituting the entire Board. The Board currently consists of nine members, of whom Mr. Dent, Dr. Stead,Messrs. Frist and Gordon and Ms. TateRappuhn are standing for re-election as Class IIII Directors as set forth under “Proposal One – Election of Directors.”

The names and certain information about members of the Board are set forth below.

Name | Age | Positions with the Company | Director Since | Class and Year in Which Term Will Expire | Age | Positions with the Company | Director Since | Class and Year in Which Term Will Expire | ||||||||

Robert A. Frist, Jr. | 55 | Chief Executive Officer and Chairman of the Board | 1990 | Class III, 2024 | 57 | Chief Executive Officer and Chairman of the Board | 1990 | Class III, 2024 | ||||||||

Thompson S. Dent | 72 | Director | 1995 | Class I, 2022 | 74 | Director | 1995 | Class I, 2025 | ||||||||

Frank Gordon | 59 | Director | 2002 | Class III, 2024 | 61 | Director | 2002 | Class III, 2024 | ||||||||

| Alex Jahangir, M.D. | 45 | Director | 2023 | Class II, 2026 | ||||||||||||

Jeffrey L. McLaren | 55 | Director | 1990 | Class II, 2023 | 57 | Director | 1990 | Class II, 2026 | ||||||||

Terry Allison Rappuhn | 65 | Director | 2022 | Class III, 2024 | 67 | Director | 2022 | Class III, 2024 | ||||||||

Linda Rebrovick | 66 | Director | 2001 | Class II, 2023 | 68 | Director | 2001 | Class II, 2026 | ||||||||

Michael D. Shmerling | 66 | Director | 2005 | Class II, 2023 | ||||||||||||

William W. Stead, M.D. | 73 | Director | 1998 | Class I, 2022 | 75 | Director | 1998 | Class I, 2025 | ||||||||

Deborah Taylor Tate | 65 | Director | 2010 | Class I, 2022 | 67 | Director | 2010 | Class I, 2025 | ||||||||

Robert A. Frist, Jr., one of our co‑founders, has served as our Chief Executive Officer and Chairman of the Board of Directors since 1990. Mr. Frist graduated with a Bachelor of Science in Business with concentrations in Finance, Economics, and Marketing from Trinity University.

The Company believes that Mr. Frist’s experience managing the day-to-day operations of the Company’s business, along with his active involvement with the Company since its inception and his comprehensive understanding of the Company’s mission, give him the qualifications and skills to serve as a director.

Thompson S. Dent ishas served as the Chief Executive Officer and Chairman of the Board of Directors of Urgent Team, LLC, an independent operator of urgent care centers.centers, since 2013. Mr. Dent ishas also served as the co-founder and Executive Chairman of Re:Cognition Health, Ltd. London, England, an independent provider for cognitive disorders and pharmaceutical clinical trials in AlzheimersAlzheimer's and other CNS diseases.diseases, since 2010. He served as executive chairman and chief executive officer of MedTel International Corporation, an international diagnostic imaging company based in Nashville, TN, from 2004 to 2008. Mr. Dent holdsearned a Masters in Healthcare Administration from The George Washington University and a Bachelor’s degree in Business from Mississippi State University. He has served as our lead Independent Director since December 15, 2014.

The Company believes that Mr. Dent’s decades of healthcare services industry expertise, including service on numerous healthcare company boards and committees, give him the qualifications and skills to serve as a director.

Frank Gordon has served as managing partner of Crofton Capital LLP, a private equity fund, since 2002. Mr. Gordon currently serves on the board of directors of a number of non-profit organizations and private companies. Mr. Gordon earned a Bachelor of Science from the University of Texas in Austin and a Masters in Business Administration from Georgia State University.

The Company believes that Mr. Gordon’s extensive healthcare business experience, including, but not limited to, service as a director in a management capacity and as an investor with both start-up and well establishedwell-established companies, gives him the qualifications and skills to serve as a director.

Alex Jahangir, M.D. is the vice president for business development, vice-chair of orthopaedic surgery, and director of the division of orthopaedic trauma at Vanderbilt University Medical Center. Since joining Vanderbilt University Medical Center in 2009, Dr. Jahangir has also served as the executive medical director of the Vanderbilt Trauma, Burn, and Emergency Surgery Patient Care Center and associate chief of staff for Vanderbilt University Hospital. Dr. Jahangir is a co-founder and director of Pendant Biosciences, an advanced biotechnology startup developing biocompatible polymer systems. Dr. Jahangir previously served two terms as chairman of the Nashville Metropolitan Board of Health and was named chairman of the Metropolitan Nashville Coronavirus Taskforce by Mayor John Cooper at the onset of the COVID-19 pandemic in March 2020 where he led Nashville’s response, developing and implementing policies that mitigated the spread, bringing stakeholders across the city together, spearheading access to testing and vaccination for vulnerable communities, and serving as the public’s primary source for information about the city’s effort to keep residents safe and healthy. Dr. Jahangir earned a Bachelor of Science from The George Washington University, a Masters of Management in Healthcare from Vanderbilt University, Owen Graduate School of Management, and an M.D. from the University of Tennessee.

The Company believes that Dr. Jahangir's extensive experience leading an academic medical center, a metropolitan public health department, and a biotechnology company gives him the qualifications and skills to serve as a director.

Jeffrey L. McLaren ishas served as the founder, and chief executive officer, and director of Medaxion, Inc., a leading provider of mobile anesthesia information solutions.solutions, since 2008. Mr. McLaren served as the chief executive officer of SaferSleep, LLC, a provider of anesthesia information management systems from 2004 to 2007. He served as the chief executive officer of Southern Genesis, LLC, a management consulting company from 2003 to 2010. Mr. McLaren, also one of our co-founders, served as our President from 1990 to 2000 and as our Chief Product Officer from 1999 to 2000. Mr. McLaren graduated from Trinity University with a Bachelor of Arts in Business and Philosophy.

The Company believes that Mr. McLaren’s extensive healthcare business expertise, along with his intimate knowledge of the Company’s operations, givegives him the qualifications and skills to serve as a director.

Terry Allison Rappuhn served on the board of directors of Quorum Health Corporation ("QHC"), a publicly-held operator of general acute care hospitals and outpatient services from 2017 to 2020. She was chair of theQHC's board of directors from 2018 to 2020 and chair of theQHC's audit committee from 2017 until 2018. She served Akorn, Inc., a publicly-held pharmaceutical company, as a director from 2015 to 2020, including serving as a member of the nominating and governance committee and as the chair of the audit committee. From 2016 to 2017, Ms. Rappuhn served on the board of directors and audit committee of Span-America Medical Systems, Inc., a publicly-held manufacturer of beds and pressure management products for the medical market. From 2006 to 2010, she served as a director and chaired the audit committee of AGA Medical Holdings, Inc., a medical device company. From 2003 to 2007, she served as a director of Genesis HealthCare Corporation, where she chaired the audit committee, and from 2017 to 2021, she served on the board of Genesis Healthcare, Inc., an operator of skilled nursing and assisted living centers. From 1999 to April 2001,Previously, Ms. Rappuhn also served as Senior Vice President and Chief Financial Officer of Quorum Health Group, Inc., ana publicly-held owner and operator of acute care hospitals. Ms. Rappuhn has 15 years of experience with Ernst & Young LLP, is a Certified Public Accountant, and holds the NACD CERT Certificate in Cybersecurity Oversight issued by NACDCyber-Risk Oversight. In addition, Ms. Rappuhn co-founded an agency that makes critical home repairs and Carnegie Mellon University.mobility modifications, empowering older adults and people with disabilities to age in place safely and with dignity. Ms. Rappuhn graduated from Middle Tennessee State University with a Bachelor in Business Administration.

The Company believes that Ms. Rappuhn’s extensive financial and healthcare industry expertise, including service on numerous healthcare company boards and committees, givegives her the qualifications and skills to serve as a director.

Linda Eskind Rebrovickis President of Impact Corporate Consulting, providing business consulting and board services. In addition to HealthStream, Inc.,where she has served since 2018. Ms. Rebrovick serveshas served on the Boardsboards of Directorssix public and private companies (not including her Board service with the Company). Ms. Rebrovick currently serves as a director of Guidehouse,the following private companies: J2 Software, Inc. (doing business as CivicEye) and Consensus Point, Inc. and previously aIn addition, she formerly served on the boardprivate company boards of directors of Reliant Bancorp,Guidehouse, Inc., KPMG LLP, and Tribridge Enterprises, Inc. and Tribridge Enterprise,the corporate boards of Pinnacle Financial Partners, Inc. and Reliant Bancorp, Inc. From April 2018 to June 2018, she served as Chief Executive Officer of Integrated Healing Technologies. While serving as Chief Executive Officer of Integrated Healing Technologies, where she assisted the company with its evaluation of potential strategies and alternatives, which ultimately leadled to the board decidingboard's decision to wind down the company and file for Chapter 7 bankruptcy protection in the Middle District of Tennessee on July 9, 2018. The bankruptcy case was closed on February 16, 2021. In addition,

Ms. Rebrovick previously served as Senior Client Partner, Healthcare and Technology, with Morgan Samuels, an executive search firm. Ms. Rebrovick was a candidate in 2015 for the office of Mayor, Metropolitan Nashville and Davidson County Government, and, from 2009 to 2014, she was Chief Executive OfficerCEO of Consensus Point, a global provider of innovative prediction market research technology solutions.

Inc. and held executive leadership roles at Dell, KPMG Consulting, BearingPoint, and IBM. As Area Vice President, of Dell Healthcare and the EVP, Managing Partner, Healthcare, at KPMG Consulting, she was responsible for full-service businessthe national healthcare businesses, providing consulting, including process improvement, organizational analysis, and implementation of healthcare technology solutions.solutions for their clients. As the Chief Marketing Officer of BearingPoint, Inc., she led the global marketing organization and managed the successful rebranding of the global consulting business in 40 countries. She beganDuring her 16-year career with IBM, as ashe was promoted from Marketing Representative to Marketing Manager and Business Unit Executive.

Ms. Rebrovick iswas a Senior2021 Fellow, Harvard University, Advanced Leadership Initiative, Harvard University. In 1977, she earned aInitiative. She received her Bachelor of Science, in Marketing, from Auburn University, Harbert College of Business. She has been recognized as a member of ODK and was later selected as one of theirthe Top 400 Women Graduates of the past 100 years.years at Auburn University.

Ms. Rebrovick iswas a candidate for Mayor, Metropolitan Nashville and Davidson County Government, in 2015. Her current community activities include the President,Advisory Board, Harvard University, Edmond & Lily Safra Center for Ethics; Board of Trustees, Leadership Nashville.Nashville; and Board of Directors, Middle Tennessee Community Foundation. She is a founder and former Co-Chair of the Co-Founder,Tennessee Chapter, Women Corporate Directors, Tennessee and serves on the Board and Executive Committee, Nashville Entrepreneur Center.she was recognized as a "Director to Watch" by Directors & Boards.

The Company believes that Ms. Rebrovick’s public and private company board and executive experience, technology, market research and sales expertise, and background as a healthcare executive with global management technology and consulting companies, give her the qualifications and skills to serve as a director.

Michael D. Shmerling is Chairman of Clearbrook Holdings Corp, a diversified private investment firm. Mr. Shmerling formerly served as the Chief Operating Officer, Executive Vice President and Board member of Kroll, Inc. and, following its sale to Marsh Inc., as a senior advisor to Marsh Inc. Mr. Shmerling currently serves on the board of directors of Renasant Corporation (Nasdaq: RNST), the public registered parent of the financial institution Renasant Bank, as well as several non-profit organizations. Mr. Shmerling received a Bachelor of Accountancy degree from the University of Oklahoma. He has been licensed as a CPA for 44 years (currently inactive).

The Company believes that Mr. Shmerling’s financial and business expertise, including a diversified background of managing and directing a variety of public and private companies, give him the qualifications and skills to serve as a director.

William W. Stead, M.D. is McKesson Foundation Professor in the Department of Biomedical Informatics and Professor of Medicine at Vanderbilt University Medical Center, where he has served as Chief Strategy Officer (2009-2020), Chief Information Officer (1991-2013) and associate vice chancellor for health affairs of Vanderbilt University (1991 to 2016). He is a founding fellow of the American College of Medical Informatics and the American Institute for Engineering in Biology and Medicine and a member of the National Academy of Medicine. He currently serves as member of the Audit Committee, National Academy of Sciences and served as a presidential appointee to the Systemic Interoperability Commission. He is past chairman, National Committee for Vital Health and Statistics, Department of Health and Human Services, Board of Regents, National Library of Medicine, and past president of the American College of Medical Informatics. Dr. Stead earned a Bachelor of Arts in Chemistry and an M.D. from Duke University.

The Company believes that Dr. Stead’s service as chief strategy officer for Vanderbilt University Medical Center, plus leadership in organizations devoted to the study of biomedical informatics, give him the qualifications and skills to serve as a director.

Deborah Taylor Tate previously served as the Director of the Administrative Office of the Courts for the Tennessee Supreme Court and State of Tennessee from 2015 to 2022. She also served as a member of the American Judges Association and the Conference of State Court Administrators, where she was on the national board of directors until February 2022. For the past three years,In addition, Ms. Tate served as National Co-chair of the National Judicial Opioid Task Force, developing and implementing training and resources regarding the opioid epidemic to thousands of judges across the nation.nation from 2017 to 2021. Ms. Tate, a licensed attorney, served as the Tennessee Supreme Court’s appointee to numerous state boards and commissions, including the Tennessee Consolidated Retirement System Board overseeing the state’s $60 billion pension fund, where she also was elected to the Audit Committee until February 2022. Ms. Tate previously served on the Tennessee Information Systems Council, which oversees all technology projects for the State of Tennessee. Currently, Ms. Tate serves as the Vice President on the Executive Board of the Leadership Nashville Alumni Association. Nationally, she serves as vice-chairman of the national Multicultural Media, Telecommunications and Internet Council.Council, a position she has held since 2021. She was twice-nominated to the Federal Communications Commission (FCC) by President George W. Bush and unanimously confirmed by the U.S. Senate in 2005. She served as the only female Commissioner of the FCC until 2009, serving as chair of two Federal Joint Boards regarding advanced communications services and represented the FCC internationally at the International Telecommunications Union (ITU) and in bilateral telecommunications negotiations. She was named the first ITU Envoy for her work with children’s internet policy as well as receiving the honor of Laureate for Childhood Online Protection. At the time of her presidential appointment, Ms. Tate was serving as the chairman and director of the Tennessee Regulatory Authority, the state regulatory body for all telecom and utility companies and previously served as executive director of the Health Facilities Commission overseeing the state’s healthcare facility and services regulation. Ms. Tate served on the legal counsel and senior staff for former Senator Lamar Alexander, and former Governor Don Sundquist. She presently serves as vice-chair of the Council of National Policy Committee forAdvisors to Centerstone Research Institute,America, the leading informatics, analytics, and clinical research provider for behavioral healthcare. Ms. Tate received both her undergraduate degree and Juris Doctorate (J.D.) from the University of Tennessee, and also attended Vanderbilt Law School.

Ms. Tate serves as a Trustee for the Community Foundation of Middle Tennessee and helped co-found numerous organizations including a residential placement for mothers and children affected by addiction and a financial literacy program for middle and high school girls. She has received numerous state, national, and international awards for her professional, public and nonprofit service including the End Slavery Public Service award for her work with Human Trafficking and the Justice Janice Holder Access to Justice Award for her national work in the opioid crisis. In 2023, Ms. Tate was honored by both Houses of the Tennessee General Assembly with a Joint Resolution to honor her lifetime of public service to the state and nation as well as her non-profit work with families and children.

The Company believes that Ms. Tate’s extensive background in various legal, leadership, and policymaking roles with both healthcare companies and state and federal regulatory agencies gives her the qualifications and skills to serve as a director.

Our business is managed under the direction of our Board. Our Board is responsible for establishing our corporate policies and strategic objectives, reviewing our overall performance, and overseeing management’s performance. The Board delegates the conduct of the business to our senior management team. Directors have regular access to senior management. They may also seek independent, outside advice. The Board oversees all major decisions to be made by the Company. The Board holds regular quarterly meetings, an annual strategic planning meeting, and meets on other occasions when advisable. The Board operates pursuant to our Corporate Governance Principles, a copy of which may be accessed in the “Corporate Governance” section of the Investor Relations page of our website at www.healthstream.com.

During 2021,2023, our Board held fivetwelve meetings, the Audit Committee of our Board (the “Audit Committee”) held fivesix meetings, the Compensation Committee of our Board (the “Compensation Committee”) held threefive meetings, and the Nominating and Corporate Governance Committee held five meetings. Each of our directors attended at least 75% (in the aggregate)90% of the meetings of the board and the committees on which such director served during 2021.2023 in the aggregate. In addition, (1) each of our directors attended all of our board meetings in 2021,2023, except for one membertwo members who waswere unable to attend one meeting, (2) each of our directors serving on the Compensation Committee in 20212023 attended all of the committee meetings in 2021,2023, (3) each of our directors serving on the Nominating and Corporate Governance Committee attended all of the committee meetings in 2021, except for one member who was unable to attend one meeting,2023, and (4) each of our directors serving on the Audit Committee attended all of the committee meetings in 2021.2023. Our Board has adopted a policy strongly encouraging all of our directors to attend the annual meeting of shareholders. For thisthe Annual Meeting, the attendance of our directors will be on a remote basis as the result of the fact that we are holding a virtual annual meeting as reflected herein. All directors attended, on a remote basis, our prior annual meeting of shareholders in May 2021,2023, which was similarly held on a virtual basis as the result of the COVID-19 pandemic.basis.

Each of our independent directors also devotes his or her time and attention to the Board’s standing committees. The Board has established three standing committees consistent with the rules of the Nasdaq Stock Market so that certain areas can be addressed in more depth than may be possible at a full Board meeting. Ad hoc task forces of board members may also be formed from time to time to consider acquisitions or other strategic issues. Each standing committee has a written charter that has been approved by the committee and the Board and that is reviewed at least annually. The committees, their primary functions, and memberships are as follows:

Audit Committee. The Audit Committee’s primary duties and responsibilities are oversight of the integrity of HealthStream’s financial reporting process; oversight of our system of internal controls regarding finance, accounting, and legal compliance; oversight of the processprocesses and programs utilized by management for identifying, evaluating, and mitigating various risks inherent in the Company’s business, including without limitation, enterprise security risks such as privacy, data, cyber securitycybersecurity and information security; selecting and evaluating the qualification, independence, and performance of our independent registered public accounting firm; monitoring compliance with the Company’s Code of Ethics for executive officers and directors and Code of Conduct; monitoring the reporting hotline; and providing an avenue of communication among the independent registered public accounting firm, management, and the Board.

The Audit Committee operates pursuant to the terms of an Audit Committee Charter, a copy of which may be accessed in the “Corporate Governance” section of the Investor Relations page of our website at www.healthstream.com. The current members of the Audit Committee are Michael D. Shmerling (Chair), Terry Allison Rappuhn (Chair), Linda Rebrovick, and William W. Stead, M.D. The members of the Audit Committee during 2021, following C. Martin Harris, M.D.’s decision to resign from the Company’s Board of Directors effective February 26, 2021,2023, were Michael D. Shmerling (Chair), Linda Rebrovick, and William W. Stead, M.D., Terry Allison Rappuhn, Alex Jahangir, M.D., and Linda Rebrovick. Ms. Rappuhn was appointed Chairperson of the Audit Committee in May 2023 upon the retirement of Mr. Shmerling and has continued to serve as Chairperson of the Audit Committee since such time. Dr. Jahangir was appointed a member of the Audit Committee in June 2023 and served in such role until such time that he was appointed to the Nominating and Governance Committee in July 2023. Ms. Rebrovick was appointed a member of the Audit Committee in July 2023 and has continued to serve in such role since such time. See “Audit Committee Report for 2021.2023.”

The Board has determined that all members of the Audit Committee are financially literate under the current listing standards of the Nasdaq and are independent within the meaning of the listing standards of Nasdaq and Rule 10A-3 of the Securities Exchange Act. The Board also determined that each of Michael D. Shmerling and Terry Allison Rappuhn qualifies as an “Audit Committee Financial Expert” as defined by the regulations of the SEC adopted pursuant to the Sarbanes-Oxley Act of 2002.

What is the Audit Committee’s and the Board’s role in overseeing information security?

The Company’s cybersecurity risk management program is designed to employ industry best practices, including ongoing enhancement of governance, risk, and compliance management, regular updates to our response planning and protocols, security policy and standards maintenance, and new technology implementation to proactively monitor vulnerabilities and reduce risk, including processes designed to identify material cybersecurity risks associated with our use of third-party service providers. This program includes the engagement of consulting firms and other third parties. The Company placesmaintains cyber liability insurance to help mitigate potential liabilities resulting from cybersecurity matters.

The Company’s cybersecurity risk management processes are integrated into the utmost importance on information security and privacy, including protectingCompany’s overall risk management program. In this regard, our Board of Directors has designated the data of our customers, their employees, and their patients. The Audit Committee as being primarily responsible for overseeing risk management at a board level, and has primarydelegated certain specific categories of risk oversight responsibility regardingmatters to the Company’s information security programs, including privacy, data, cyber security, and information security risk exposures. The Audit Committee receives updates at least quarterly from management coveringas well as to the Company’s programs for managing information security risks, including data privacy and data protection risks. Theother standing committees of the Board, within their respective areas of responsibilities. Additionally, the Audit Committee thenmakes periodic reports to the Board on a least a quarterly basis on such matters. The Company has adoptedregarding briefing and reports provided by management and advisors regarding various risk oversight matters as well as the National Institute of StandardsAudit Committee’s own analysis and Technology Cybersecurity Framework to assessconclusions regarding the maturity of its cybersecurity programs. Other aspectsadequacy of the Company’s comprehensive information security program include:

| ||

The Company’srisk management regularly monitors best practices in this area and seeks to implement changes to the Company’s security programs as needed to ensure the Company maintains a robust data security and privacy program. The Company also maintains a cyber security insurance policy that provides coverage for certain cyber-related security incidents.

For additional information, see Part I, Item 1C of our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 26, 2024.

Compensation Committee. The Compensation Committee has responsibility for reviewing and approving the salaries, bonuses, and other compensation and benefits of our executive officers; evaluating the performance of the Chief Executive Officer; establishing and reviewing Board compensation; reviewing and advising management regarding benefits and other terms and conditions of compensation of management; reviewing the Compensation Discussion and Analysis section of this proxy statement; issuing the Compensation Committee report included in this proxy statement; and administering the Company’s 2016 Omnibus Incentive Plan (the “2016 Plan”"2016 Plan") and 2022 Omnibus Incentive Plan (the "2022 Plan"), including cash bonus plans adopted pursuant to the terms of the 20162022 Plan for our Named Executive Officers.Officers; and overseeing and administering the Company's compensation recoupment policy. The Compensation Committee operates pursuant to the terms of a Compensation Committee Charter, a copy of which may be accessed in the “Corporate Governance” section of the Investor Relations page of our website at www.healthstream.com. The current members of the Compensation Committee are (and the members of the Compensation Committee during 20212023 were) Frank Gordon (chair), Linda Rebrovick, and Jeffrey McLaren, each of whom is independent within the meaning of the listing standards of Nasdaq. See “Compensation Committee Report for 2021.2023.”

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee provides assistance to the Board in identifying and recommending individuals qualified to serve as directors of the Company, reviews the composition of the Board, reviews and recommends corporate governance policies for the Company, reviews the management succession plan of the Company and annually evaluates the skills and performance of the Board, oversees environmental, social, and governance (ESG)("ESG") considerations impacting the Company, and reviews and oversees diversity-related initiatives, policies and procedures that the Company may adopt with the guidance and supervision of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to the terms of a Nominating and Corporate Governance Committee Charter, a copy of which may be accessed in the “Corporate Governance” section of the Investor Relations page of our website at www.healthstream.com. The current members of the Nominating and Corporate Governance Committee are (and theThompson Dent (chair), Alex Jahangir, M.D., and Deborah Taylor Tate. The members of the Nominating and Corporate Governance Committeecommittee during 2021 were)2023 were Thompson Dent (chair)(Chair), Alex Jahangir, M.D., William W. Stead, M.D., and Deborah Taylor Tate. Dr. Jahangir was appointed to the Committee in July 2023 in place of Dr. Stead. Mr. Dent, Dr. Jahangir, Dr. Stead, and Ms. Tate are each of whom is independent within the meaning of the listing standards of Nasdaq.

Our Chairman and Chief Executive Officer proposes the agenda for the Board meetings and presents the agenda to the Nominating and Corporate Governance Committee, which reviews the agenda with our Lead Independent Director and our Chairman and Chief Executive Officer, and may raise other matters to be included in the agenda or at the meetings. All directors receive the agenda and supporting information in advance of the meetings. Directors may raise other matters to be included in the agenda or at the meetings. Our Chairman and Chief Executive Officer and other members of senior management make presentations to the Board at the meetings and a substantial portion of the meeting time is devoted to the Board’s discussion of and questions regarding these presentations.

The independent directors meet in executive session (i.e., with no members of management present) periodically, in at least two regularly scheduled meetings each year. The Lead Independent Director, or his or her designee, presides at these meetings.

The Board has determined that Thompson S. Dent, Frank Gordon, Alex Jahangir, M.D., Jeffrey L. McLaren, Terry Allison Rappuhn, Linda Rebrovick, Michael D. Shmerling, William W. Stead, M.D., and Deborah Taylor Tate do not have any relationship that, in the opinion of the Board, would interfere with the exercise of the director’s independent judgment in carrying out the responsibilities of a director and that such directors are “independent” under the listing standards of Nasdaq. In addition, all of the standing committees of the Board are comprised solely of independent directors as set forth above. Robert A. Frist, Jr., our Chief Executive Officer and Chairman, is not independent under the Nasdaq listing standards.standards and does not serve on any standing committee.

During this review, the Board considered whether there are or have been any transactions, relationships, or arrangements involving our non-management directors (including family members) that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director of the Company in accordance with Nasdaq listing standards. The purpose of this review was to determine whether any of these relationships, transactions, or arrangements were inconsistent with a determination that such non-management directors were independent. In making its independence determinations, the Board considered the ordinary course, non-preferential relationships involving non-management directors set forth in the paragraph below, and determined that none of these relationships would cause such non-management directors to not be independent.

HealthStream in the ordinary course of business has certain vendor agreements or banking relationships with entities where Messrs. Dent and McLaren, two of our directors, serve as executive officers or board members (Messrs. Dent and Shmerling).officers. These vendor agreements are for certain of the Company's SaaSsoftware-as-a-service offerings that are used broadly throughout the healthcare provider market, and thesuch agreements do not involve consulting or professional services. The banking relationship is a depository account. In each case, the Company considered the types and amounts of commercial dealings between the Company and the organizations with which the directorsMessrs. Dent and McLaren are affiliated as referenced above in connection with reaching its conclusion that none of these relationships constituted adid not constitute material relationshiprelationships involving theeither such director and the Company, and in each case the agreements and relationships were entered into at arms-length without the participation of the applicable board member.director.

Skills Assessment and Board Evaluation Process

The Nominating and Corporate Governance Committee is responsible for assessing the Board’s skills, evaluating director performance, and providing feedback to directors in connection with the evaluation of their performance. Further, the Nominating and Corporate Governance Committee annually assesses the skills required of the Board to support appropriate governance and corporate oversight. In connection with these responsibilities, the Nominating and Corporate Governance Committee annually conducts a board skills assessment as well as self and peer evaluations for the full Board. The Board evaluation process includes self and peer reviews, suggestions for individual improvement, and year to year comparison and trend analysis for both individual directors and the Board on a composite basis. The Board annually reviews the results to improve the effectiveness of the Board as a whole. The skills assessment and Board evaluation processes are used to determine skill requirements for new director nominations, assess committee assignments, review the qualifications of incumbent directors to determine whether to recommend them to the Board as nominees for re-election, and to facilitate improvement of the effectiveness of the Board.

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company, the membership of the Board, and the background and knowledge of the Chief Executive Officer. The Board has determined that having the Company's current Chief Executive Officer, Robert A. Frist, Jr., serve as Chairman is in the best interest of the Company's shareholders at this time. The Board believes that this structure makes the best use of Mr. Frist's extensive knowledge of the Company and its industry and also facilitates effective communication between the Company's management and the Board. The Board also believes that, in light of the combined role of the Chairman and Chief Executive Officer at the Company, it is beneficial to the Company and its investors to have a strong Lead Independent Director with clearly defined roles and responsibilities. The Board also believes that having Mr. Frist serve as Chairman of the Board provides an efficient and effective leadership model for us by fostering clear accountability, effective decision making, and alignment of corporate strategy. The Board believes that its current management structure, together withtaking into account the significant duties of the Lead Independent Director having the dutiesas described below, is in the best interest of shareholders and strikes an appropriate balance for the Company.

Thompson S. Dent serves as Lead Independent Director—a position that, at HealthStream, entails significant responsibility for independent Board leadership as noted in more detail below. During his tenure as a director, Mr. Dent has demonstrated strong leadership skills and independent thinking as well as a deep understanding of the Company’s business.

The position of Lead Independent Director at HealthStream comes with a clear mandate and significant authority and responsibilities under a Board-approved charter. These responsibilities and authority include the following:

● | presiding at all meetings of the Board at which the Chairman and Chief Executive Officer is not present, including executive sessions of the independent Directors; |

● |

|

● | serving as a liaison between the independent Directors and the Chairman and Chief Executive |

|

|

|

|

● | approving, in consultation with the Chairman and Chief Executive Officer, meeting |

● | approving the type of information sent to the Board; |

● | facilitating the Board’s approval of the number and frequency of Board meetings and approving |

● |

|

|

|

● | being available to meet with major shareholders, upon their reasonable request, to receive input and ensure that such input is communicated to the independent directors and, as appropriate, management. |

The Charter of the Lead Independent Director can be found on our website at www.healthstream.com (under the “Corporate Governance” section of the Investor Relations page).

The Board believes that an effective risk management system should be focused on (1) timely identifying the material risks that the Company faces, (2) communicating necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee, (3) implementing appropriate and responsive risk management strategies consistent with the Company's risk profile, and (4) integrating risk management into Company decision-making. The Board has designated the Audit Committee to take the lead inas being primarily responsible for overseeing risk management at a board level and has delegated certain specific categories of risk oversight matters to the Audit Committee. Additionally, the Audit Committee makes periodic reports to the Board regarding briefings and reports provided by management and advisors regarding various risk oversight matters as well as the Audit Committee's own analysis and conclusions regarding the adequacy of the Company's risk management processes. Aprogram. Moreover, the Audit Committee oversees significant financial risk exposures and the steps that management has taken to monitor, control, and report such exposures. Another particular area of risk that the Audit Committee evaluates and oversees on a regular basis is that of cyber securitycybersecurity and information security. A summary of this review is also provided as part of the Audit Committee’s reportby management to the Board during each quarterly Board meeting. In addition, the Board encourages management to promote a corporate culture that incorporates risk management into the Company's corporate strategy and day-to-day business operations. The Board also works, with the input of the Company's executive officers, to assess and analyze the most likely areas of future risk for the Company. Additionally,

In addition to the oversight responsibilities of the Audit Committee as summarized above, the Board has delegated certain other categories of risk oversight to the other standing committees of the Board within their areas of responsibility or as may otherwise be delegated by the Board. In this regard, on an annual basis the Nominating and Corporate Governance Committee, in conjunction with the Audit Committee, reviews and recommends an Incident Response Policy for the Board’s approval. The Incident Response Policy is intended to categorize certain risk scenarios, designate members of senior management charged with addressing them, and provide for escalation of certain risk events from management to the appropriate Board Committee or the Board as a whole. Moreover,In addition, the Nominating and Corporate Governance Committee oversees ESG risks which may impact the Company.

In addition to the Audit Committee, the other committees of the Board consider the risks within their areas of responsibility. In this regard, Moreover, the Compensation Committee considers the risks that may be implicated by our executive compensation programs. Based upon the comprehensive review of the executive compensation programs, the Compensation Committee has concluded that the Company’s executive compensation programs are not reasonably likely to have a material adverse effect on the Company as a whole.

Corporate SustainabilityResponsibility – Environmental, Social, and Governance

We believe that incorporating corporate responsibility and environmental, social and governance (ESG)ESG concerns into our day-to-day business operations helps promote long-term growth for our company. Both the Nominating and Corporate Governance Committee and the Board receive periodic reports from management on our ESG initiatives, which include the following:

Diversity, Equity, & Inclusion. We are committed to fostering a work culture that promotes diversity, equity, and inclusion.inclusion ("DEI"). Our DEI strategy is grounded in our corporate DEI Point-of-View statement and demonstrates our commitment to advancing and preserving a culture of DEI. In 2021, we expanded2023, StreamForward, our employee-led DEI initiative, highlighted the scopeimportance and benefits of our diversity, equity, and inclusion program, StreamForward, through the formation of the StreamForward Steering Committee which is focused on creating a more diverse, equitable, and inclusive organization. StreamForward’s efforts, among other things, focus onorganization through education, content, programs, and training that enhance cultural competency, reduce bias, and promote a culture of belonging. In 2022, we launched DEI training for all managers, supervisors, and executives with an emphasis on unconscious bias, leading diverse teams, and fostering a diverse workplace and culture, which we subsequently expanded to the Company’s workforce as a whole during 2023. Our commitment to creating a more inclusive organization makes us a stronger organization and, in turn, drives our actions to make a positive impact on the equitable delivery of healthcare. Our DEI Point-of-View may be accessed in the “Corporate Governance” section of the Investor Relations page of our website at www.healthstream.com

Community Engagement. Guided by the Constitutional value of “streaming good,” we strive to create a positive social impact on the communities we serve. Being outstanding stewards of our communities – at all levels – is expected of employees as we recognize the value of “giving back” to others. We live this value through our Streaming Good corporate social responsibility program which enables employees to participate in various initiatives to support our current selected organization, The American Cancer Society. Additionally, all employees are provided with paid time off to volunteer at the not-for-profit organization of their choosing through our Paid Time Off program.

Environmental Sustainability. We believe in operating our business in an environmentally responsible manner, as evidenced by our selection of a LEED-certified building as our corporate headquarters.

COVID-19 Response and Employee Health and Safety. We are committed to providing a healthy and safe working environment for our employees. In response to the ongoing COVID-19 pandemic, a key priority and concern has been and remains the health and safety of our employees. At the outset of the pandemic, we required employees at all of our offices, including our corporate headquarters, to work remotely and implemented travel restrictions enterprise wide. Beginning December 1, 2021, we began to re-open our offices on a graduated basis for employees and implemented a hybrid work policy, where employees can choose to split time between working from an office and working from home or to work solely from home or other appropriate remote location (in addition to having the option of working primarily from our offices).

Nominating Committee Process and Board Diversity

The Nominating and Corporate Governance Committee is responsible for identifying qualified individuals to serve as members of the Company’s Board as well as reviewing the qualifications and performance of incumbent directors to determine whether to recommend them to the Board as nominees for re-election. In identifying candidates for membership on the Board, the Nominating and Corporate Governance Committee takes into account all factors it considers appropriate, which may include (a) ensuring that the Board, as a whole, is diverse and consists of individuals with various and relevant career experience, technical skills, industry knowledge and experience, financial expertise (including expertise that could qualify a director as an “audit committee financial expert,” as that term is defined by the rules of the SEC), and local or community ties and (b) appropriate qualifications on an individual level, including strength of character, mature judgment, time availability, familiarity with the Company’s business and industry, independence of thought, and an ability to work collegially. The Nominating and Corporate Governance Committee also may consider the extent to which the candidate would fill a present need on the Board. With respect to new candidates for Board service, a full evaluation generally also includes a detailed background check. With respect to the appointment of Ms. RappuhnDr. Jahangir to the Board in January 2022,May 2023, the above-described process was followed. Ms. RappuhnDr. Jahangir was recommended to the Board by one of our independent Board members, Linda Rebrovick,Chief Executive Officer and Chairman based on her knowledge of Ms. Rappuhn and theDr. Jahangir’s professional qualifications of Ms. Rappuhn, including through Women Corporate Directors, an organization to which both Ms. Rebrovick and Ms. Rappuhn belong.leadership experience in healthcare and health policy.

The Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the Nominating and Corporate Governance Committee strives to nominate directors with a variety of complementary skills and backgrounds so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee the Company's business.